Key Points

- Not all changes to tax policy have the same impact on growth. Studies indicate that tax cuts, if not well designed, could even reduce economic growth.

- Tax cuts that target new economic activity, reduce distortions to capital accumulation, and are not deficit financed are more likely to lead to economic growth.

Effects of Income Tax Changes on Economic Growth

Editor’s Note: This article is part of a series of tax-related articles sponsored by the Penn Wharton Budget Model and the Robert D. Burch Center at Berkeley. All of the articles in this series are forthcoming in a book by Oxford University Press, co-edited by Alan Auerbach and Kent Smetters.

The Effects of Income Tax Changes on Economic Growth examines the evidence on the impact of changes to individual income taxes on Gross Domestic Product (GDP), Gross National Product (GNP), and employment. William G. Gale and Andrew A. Samwick (2016) find that not all changes to individual income taxes have the same impact on growth.

A tax cut may increase economic growth by inducing individuals to work more, save more, and invest more, what economists call a “substitution effect.” However, a tax cut also increases an individual’s income which means that individuals can maintain their lifestyle by working less, saving less, and investing less, known as an “income effect.” Gale and Samwick (2016) conclude that tax cuts designed to target new economic activity, reduce distortions to the allocation of capital, and are not deficit financed are more likely to lead to economic growth.

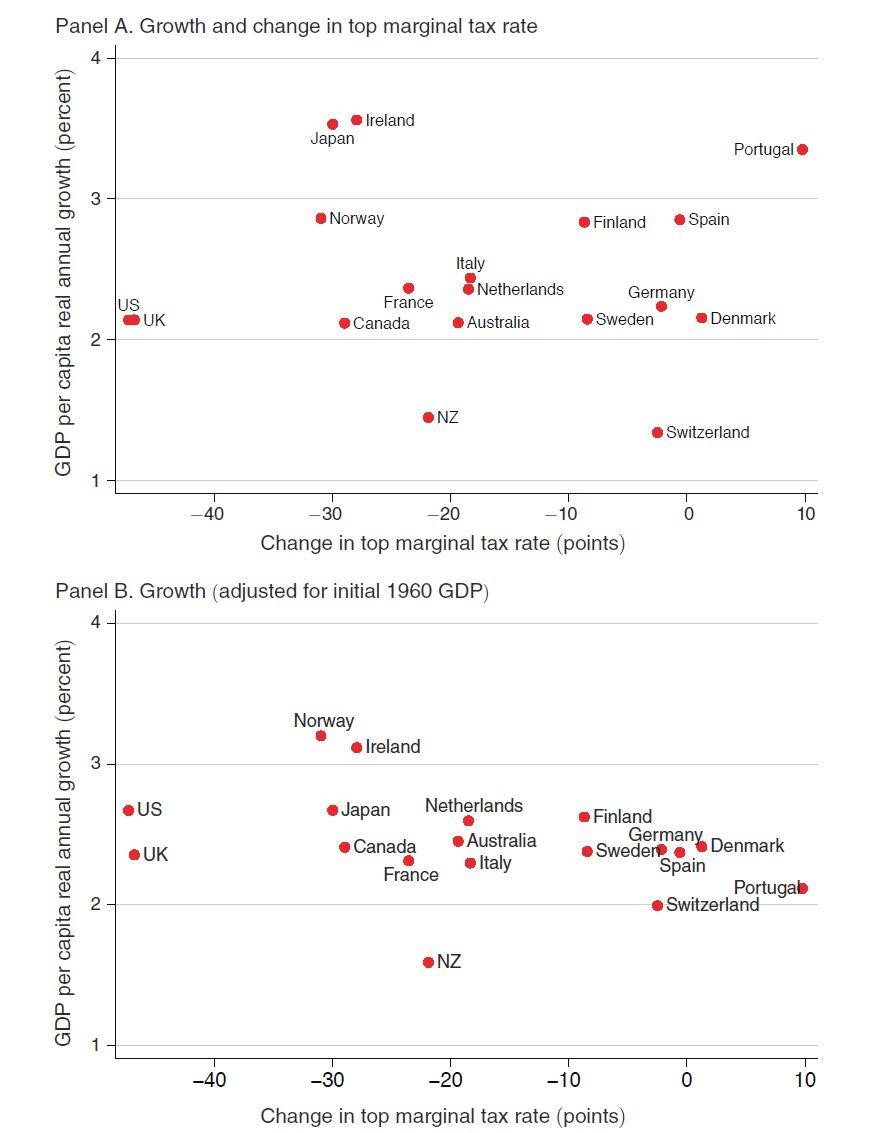

Surprisingly, advanced countries that decrease their tax rates do not experience less economic growth. Figure 1 Panel A shows that across developed countries, changes to the top individual income tax rate are not associated with economic growth. Even after adjusting for the initial size of each country’s economy, as in Figure 1 Panel B, changes to tax rates have only a weak relationship to economic growth.

Figure 1: Economic Growth Rates and Top Marginal Tax Rates, 1960-2010

Source: Piketty, Saez, and Stantcheva (2014)

Studies show that the U.S. economy has not grown in conjunction with large changes to individual income tax policy. For instance, U.S. economic growth is about the same before and after introducing income taxes and permanently higher income taxes post WWII. In addition, recent U.S. tax changes have not had a strong impact on economic growth. Figure 2 shows that tax increases in 1993 were followed by higher growth in employment and GDP that the period following tax cuts in 2001.

Figure 2: Employment and GDP Growth Following the 1993 Tax Increases and the 2001 Tax Cuts

Source: Huang (2012)

Note: The vertical axis is the average annual growth rate during the time period

Gale and Samwick find that research indicates that tax cuts have an impact on economic growth in the short-run. Tax cuts that are unrelated to current economic conditions, particularly those targeted on lower income individuals, can be followed by economic growth even a few years later.

Simulation analyses done by the Congressional Budget Office (CBO), Joint Committee on Taxation (JCT), the Federal Reserve Board, and others, shows that tax cuts financed by deficits, can boost economic growth in the short-run, but not in the long-run. Deficit financed tax cuts lead to higher taxes in the long-run, which may reduce saving. This outcome is especially likely if international capital flows are limited. However, in a more open economy, capital flows from other countries can offset some of the negative effects. Tax cuts that are off-set with spending cuts are more likely to lead to growth.

In summary, the impact of tax cuts on growth depends on how the tax cut is financed and the assumed international capital flows. Deficit-financed tax cuts are especially less likely to produce long-run growth effects. Failure of capital to flow internationally, also reduces the likelihood of success of tax rate cuts.

A discussion of this paper is provided by Kevin Hassett.