Key Points

Most of the cost of TCJA extenders arises on the federal receipts side of the budget.

By the year 2050, permanent extension of TCJA laws would reduce federal revenues from 18.4 percent to 17.1 percent of annual Gross Domestic Product (GDP). Federal debt held by the public would rise from 226.0 percent of GDP to 261.1 percent by 2050.

TCJA Extenders would increase the federal government’s permanent fiscal imbalance from 8.2 percent to 9.4 percent of all future GDP. Put differently, to avoid missing payments on its debt or other spending, the government would have to raise tax revenue, cut spending or some combination of both, by an amount equivalent in present value to 9.4 percent of all future GDP.

The Long-Term Budget Effects of Permanently Extending the 2017 Tax Cuts and Jobs Act’s Expiring Provisions

Several major provisions of the Tax Cuts and Jobs Act of 2017 are temporary and will expire (“sunset”) by the end of 2025. Some of the temporary measures began to phase out starting in 2022, while most of the temporary measures will be fully expired by the end of 2025.1

Table 1 shows estimates of changes in the federal deficit (from reduced federal receipts and higher federal expenditures) from extending the TCJA provisions over the next decade.2 Projections for 2023-32 indicate a total increase in the federal deficit of $2.8 trillion, most of it arising from the continuation of TCJA cuts to individual income taxes. By construction, these values are aligned with CBO estimates since this particular brief focuses on the longer term.

| Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2023-32 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Taxes | |||||||||||

| Individual Income Taxes | 0.0 | -0.1 | -6.0 | -167.2 | -301.2 | -295.4 | -306.6 | -316.8 | -328.6 | -345.6 | -2,067.5 |

| Business/Investment Taxes | -61.0 | -45.7 | -48.4 | -58.4 | -66.9 | -62.8 | -52.9 | -47.0 | -48.9 | -51.5 | -543.5 |

| Payroll Taxes | 0.0 | 0.0 | 0.0 | 0.5 | 0.7 | 0.7 | 0.8 | 0.8 | 0.9 | 0.9 | 5.3 |

| Estate and Gift Taxes | 0.0 | -0.1 | -0.6 | -1.9 | -13.2 | -15.0 | -16.0 | -17.1 | -17.7 | -18.6 | -100.1 |

| Expenditures | |||||||||||

| Child Tax Credit | 0.0 | 0.0 | 0.0 | -10.3 | -13.4 | -13.4 | -14.0 | -14.3 | -14.7 | -15.5 | -95.7 |

| Deficit Increase (-) | -61.1 | -45.9 | -55.0 | -237.3 | -394.0 | -385.9 | -388.8 | -394.3 | -409.0 | -430.2 | -2,801.5 |

Source: Values through 2030 from the Congressional Budget Office, Budget and Economic Outlook, May 2022, Table 5.2.

Projected values after 2030 based on PWBM’s microsimulation.

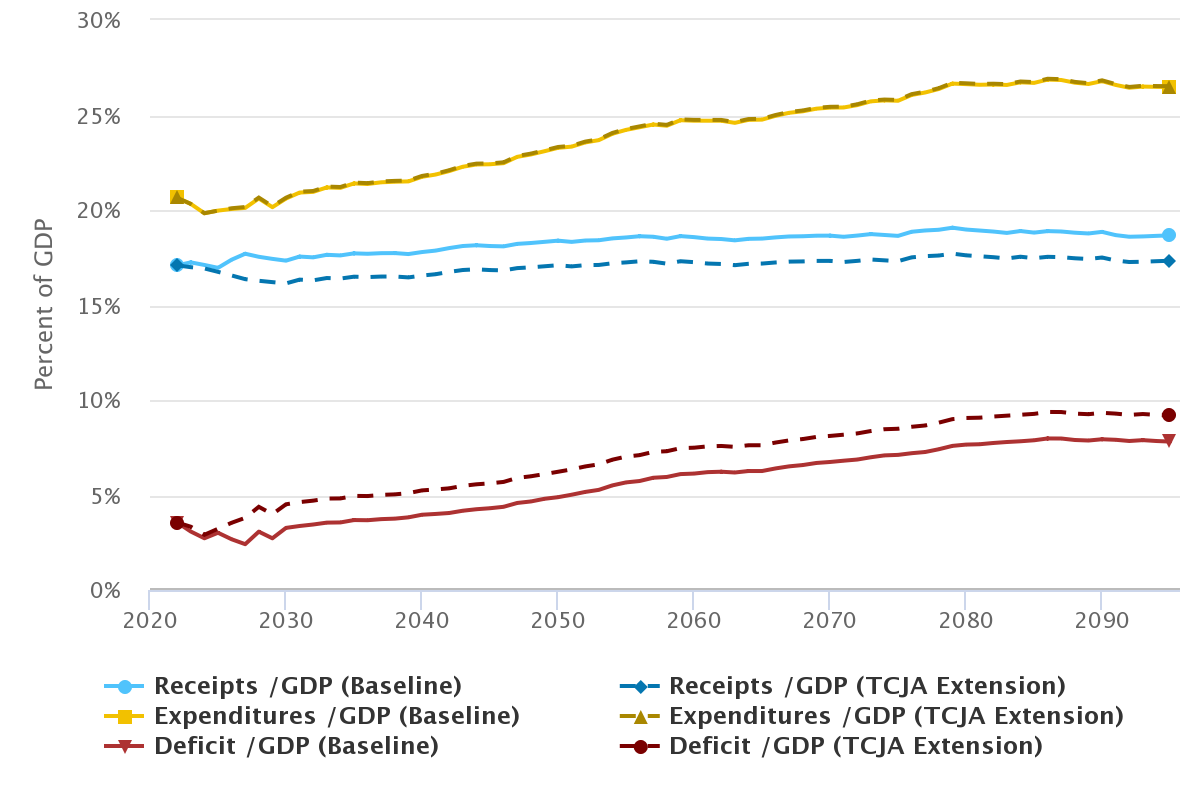

Figure 1 shows the long-term effect of extending TCJA provisions on federal receipts and annual deficits as a percentage of projected GDP. The difference between the baseline (sunset) and no-sunset alternatives on expenditures is small. However, the difference in receipts and annual deficits is larger. The net effect on the national debt grows over time due to compounding.

Source: Author’s calculations based on PWBM’s microsimulation.

For example, by the year 2030, extending TCJA provisions would reduce federal receipts from 17.3 percent to 16.1 percent of GDP. As a result, cumulative debt through the year 2030 would be 132.9 percent instead of 126.1 percent of GDP in that year. However, by the year 2050, the revenue reduction would be from 18.4 percent to 17.1 percent of GDP. By the year 2050, cumulative debt would be 261.1 percent instead of 226.0 percent of GDP in that year.

Table 2 summarizes the total federal financial shortfall with sunset (baseline) versus permanent extension (extenders). The financial shortfall is measured as federal fiscal imbalance: The present discounted value of the shortfall of annual receipts compared to annual expenditures measured over (1) the next 75 years and (2) without a time limit (infinite horizon).3

| Fiscal Imbalance | 75 years | Infinite Horizon | ||

|---|---|---|---|---|

| Sunset | No-Sunset | Sunset | No-Sunset | |

| Net Value (Trillions of dollars) | 93.3 | 109.8 | 202.9 | 231.7 |

| Percent of the Present Value of GDP | 7.0 | 8.2 | 8.2 | 9.3 |

Source: Author’s calculations based on PWBM’s microsimulation.

The fiscal imbalance measures the size of future financial shortfalls in terms of dollars today. For example, at a 5 percent interest rate, a perpetual obligation to pay of 5 cents each year is equivalent to owing $1 today. Thus, given projected federal expenditures under current spending laws, extending the TCJA would reduce federal revenues and create a larger federal funding shortfall. The fiscal imbalance metric expresses the increase in the federal funding shortfall in today’s dollars.

The federal government’s existing fiscal imbalance (under current fiscal laws including sunsets on TCJA provisions) is estimated to be $93.3 trillion over the next 75 years.4 Without time limit, the fiscal imbalance is estimated at $202.9 trillion. A permanent extension of TCJA provisions would increase the fiscal imbalance by $16.5 trillion -- from ($93.3 trillion to $109.8 trillion) over the next 75 years. Measured without a time limit, the increase in the fiscal imbalance from extending TCJA provisions would be $28.8 trillion (from $202.9 trillion to $231.7 trillion).

Measured as a percent of the present value of GDP, the 75-year fiscal imbalance increases from 7.0 percent under TCJA sunset to 8.2 percent under TCJA extension. When calculated over the infinite horizon, the federal fiscal imbalance increases from 8.2 percent under the baseline (TCJA sunset) to 9.3 percent under TCJA extension.

This analysis was produced by Jagadeesh Gokhale. Mariko Paulson prepared the brief for the website.

-

Bonus depreciation deduction of 100 percent (and a few minor provisions) began their phase-outs after 2022. Some provisions will adjust more rapidly in 2025, including the higher estate-and-gift tax exclusion limit, which will revert to the 2018 value ($5.5 million) in 2025. Several additional TCJA provisions for individuals and businesses – such as individual income tax rates, the increased child tax credit, increased alternative minimum tax threshold, increased standard deduction limits on state and local tax deduction, mortgage interest deduction, qualified business income deduction, global intangible low-taxed income deduction, foreign derived intangible income deduction etc. -- are also set to expire in 2025. ↩

-

Budget and Economic Outlook, May 2022, Congressional Budget Office, publication number 51118. Note that CBO estimates are reported through 2030. Long-term (after year 2030) annual estimates of budget effects are based on PWBM’s microsimulation. ↩

-

For a detailed definition and calculation of fiscal imbalance metric, see here. ↩

-

The current law fiscal imbalance estimates below are provided in an earlier PWBM Brief. See here. ↩

,Receipts /GDP (Baseline),Receipts /GDP (TCJA Extension),Expenditures /GDP (Baseline),Expenditures /GDP (TCJA Extension),Deficit /GDP (Baseline),Deficit /GDP (TCJA Extension) 2022,17.08600518,17.0860047,20.63964385,20.63964385,3.553638669,3.553639145 2023,17.24342515,16.98967203,20.32047523,20.32047523,3.077050075,3.330803199 2024,17.10717929,16.92433542,19.83014776,19.83014776,2.722968471,2.905812334 2025,16.95516893,16.74554003,19.96806155,19.96806155,3.012892618,3.222521523 2026,17.38389915,16.55435492,20.05431163,20.09204597,2.670412484,3.537691056 2027,17.69849945,16.35949936,20.11031346,20.15757415,2.411814012,3.798074796 2028,17.53714627,16.27482992,20.60705513,20.65246969,3.069908857,4.37763977 2029,17.42745843,16.20371701,20.1488797,20.19474824,2.721421278,3.991031234 2030,17.33412127,16.13722729,20.60298597,20.64789665,3.268864705,4.51066936 2031,17.54847967,16.33597032,20.91728287,20.96262822,3.368803201,4.626657894 2032,17.50781787,16.29744736,20.95480098,20.99993974,3.446983109,4.702492389 2033,17.64141832,16.42051607,21.18757319,21.2328771,3.546154877,4.812361029 2034,17.60955006,16.39133008,21.16554492,21.21078175,3.555994869,4.81945167 2035,17.71738346,16.49045634,21.39826583,21.443628,3.680882369,4.953171661 2036,17.69602489,16.46889639,21.36839976,21.41351421,3.672374867,4.944617823 2037,17.72780835,16.49750702,21.45809503,21.50313639,3.730286683,5.005629374 2038,17.73208697,16.5000893,21.48770027,21.53262214,3.755613299,5.032532833 2039,17.68104186,16.45215823,21.50546657,21.55019911,3.824424709,5.09804088 2040,17.78694418,16.55011058,21.7481473,21.79307004,3.961203113,5.242959464 2041,17.86291377,16.61988199,21.86581344,21.91080792,4.00289967,5.290925923 2042,17.99596984,16.74267219,22.04849678,22.09376673,4.05252694,5.351094539 2043,18.10479751,16.84231214,22.27711761,22.32245817,4.172320097,5.48014603 2044,18.14426252,16.87776517,22.39563912,22.4409132,4.2513766,5.563148031 2045,18.10358652,16.83865878,22.40727029,22.45221883,4.303683773,5.613560048 2046,18.08659901,16.8213583,22.46546291,22.51020853,4.378863901,5.688850227 2047,18.21703403,16.94171022,22.79808815,22.84306487,4.581054123,5.901354648 2048,18.26252556,16.98227773,22.92192756,22.96685487,4.659401996,5.984577139 2049,18.32330239,17.03736659,23.0933355,23.13822693,4.8,6.100860342 2050,18.386,17.09377553,23.27133852,23.3162027,4.885305151,6.222427178 2051,18.32096104,17.03157312,23.33537458,23.37994733,5.014413542,6.348374204 2052,18.3935489,17.0972227,23.55547769,23.60003818,5.161928793,6.502815483 2053,18.4076248,17.10768533,23.67785868,23.72218116,5.27023388,6.614495831 2054,18.505847,17.19730903,24.01238916,24.05684528,5.506542163,6.859536243 2055,18.55481873,17.24203288,24.21775898,24.26219105,5.66294025,7.020158173 2056,18.61967574,17.30151401,24.35591298,24.40040578,5.736237243,7.09889177 2057,18.59240423,17.27464701,24.49985592,24.54403301,5.90745169,7.269385997 2058,18.48661107,17.17553089,24.43580264,24.47954505,5.949191565,7.304014157 2059,18.6253162,17.30359389,24.72544946,24.76931164,6.100133257,7.465717752 2060,18.57294228,17.25425413,24.69998379,24.74359874,6.12704151,7.48934461 2061,18.49568391,17.18187415,24.69893202,24.742183,6.203248112,7.56030885 2062,18.47215352,17.16002273,24.69779326,24.74090307,6.225639734,7.580880345 2063,18.40321217,17.095745,24.58752816,24.63037418,6.184315992,7.53462918 2064,18.48161317,17.16831483,24.7435009,24.78649527,6.261887735,7.618180433 2065,18.49492888,17.18073657,24.75647398,24.79950341,6.261545108,7.618766831 2066,18.5589435,17.23962001,24.95811584,25.00116508,6.399172342,7.761545069 2067,18.60729213,17.28383494,25.11577355,25.15885527,6.508481414,7.87502033 2068,18.61858846,17.29379322,25.19549315,25.23854001,6.576904688,7.94474679 2069,18.64764411,17.32031182,25.33367895,25.37676289,6.686034839,8.056451076 2070,18.6508255,17.32226937,25.38850528,25.43155876,6.737679784,8.109289387 2071,18.58989547,17.26404481,25.39543956,25.4382464,6.805544093,8.174201594 2072,18.65397782,17.3228924,25.52014463,25.56307042,6.866166819,8.240178018 2073,18.73164029,17.39413641,25.71864281,25.76175086,6.987002525,8.36761445 2074,18.68534688,17.35089995,25.7703856,25.81342142,7.085038719,8.462521466 2075,18.63788353,17.30638749,25.7492922,25.79220513,7.11140867,8.485817638 2076,18.85473629,17.50743741,26.05469074,26.09808747,7.199954453,8.590650062 2077,18.9227769,17.57003999,26.1860616,26.2295929,7.263284696,8.659552908 2078,18.95993704,17.60391863,26.36901665,26.41261488,7.409079607,8.808696255 2079,19.06797487,17.70376751,26.65319432,26.69699793,7.585219453,8.993230416 2080,18.97163334,17.61414197,26.62479717,26.66837884,7.653163834,9.054236872 2081,18.91946835,17.56585531,26.5911878,26.63470204,7.67171945,9.06884673 2082,18.86663578,17.51708467,26.60364918,26.64701259,7.7370134,9.129927921 2083,18.79300059,17.44930204,26.58184121,26.62506242,7.788840624,9.175760372 2084,18.89309801,17.5409697,26.72066356,26.76394898,7.827565548,9.222979283 2085,18.80976401,17.4636124,26.69000111,26.73300826,7.880237106,9.269395863 2086,18.88876009,17.5363469,26.86444321,26.90749306,7.975683119,9.371146154 2087,18.86882729,17.51781067,26.84193385,26.88483203,7.973106555,9.367021363 2088,18.80498141,17.45871545,26.69990942,26.74261477,7.894928006,9.283899318 2089,18.76467642,17.42147132,26.63194704,26.67447121,7.867270618,9.252999889 2090,18.84849117,17.49944035,26.78225605,26.82491174,7.933764877,9.325471391 2091,18.67745111,17.34089255,26.58292181,26.62517274,7.9054707,9.28428018 2092,18.59251851,17.26207092,26.43465128,26.47666779,7.84213277,9.214596867 2093,18.60903301,17.2768381,26.49671599,26.53872805,7.887682981,9.261889952 2094,18.63911749,17.30539942,26.48050205,26.52266324,7.841384564,9.217263823 2095,18.66512459,17.32970187,26.47648846,26.51871794,7.811363871,9.189016065